In recent months we’ve sought to highlight the notion that investment markets are forward-looking, meaning that they tend to reflect aggregate investor views as to where global economies and the countries and companies that operate within them are heading, rather than where they’ve been. But what does that mean, exactly?

- It means investors tend to be more focused on the direction and pace of change in metrics that suggest a future different from the present, as opposed to looking solely at the levels of those metrics at the moment, when forming an investment opinion

- We’ve found in such discussions that it can be rather difficult to express what we mean by direction and pace of change, so—as tends to be our custom—we thought a series of charts that show what we mean might help to fortify reader understanding of these concepts

- We think that better understanding, in turn, may further support readers’ own tendencies to maintain a focus on the longer-term outcomes of present and potential future positioning of investment exposures

Podcast: Play in new window

Another Look at Inflation

Where we’ve been and where we presently are often matter less to investors than where we’re heading. Of course, where we’ll end up near always requires inexact estimation. Happily, the world offers a bounty of finance- and investment-related metrics that can be used to develop forecasts. Forecasts often are based on the extrapolation of current trends. And to measure trends and gauge their durability, we tend to focus our math on the direction and pace of change in data. To demonstrate just such a review, we’ll turn again to the metric of the moment: inflation. A measure of the year-over-year change in prices, inflation can be “noisy”, in that it can jump around on a month-to-month basis. And given that noisiness, one should not expect next month’s reading to be favorable just because the latest reading offered good news. It helps, instead, to think of each new reading as just another datum in a long series and that we actually can gain more insight into the present and future state of affairs by taking a step back and placing new data in the context of earlier reports.

Smoothing Operations

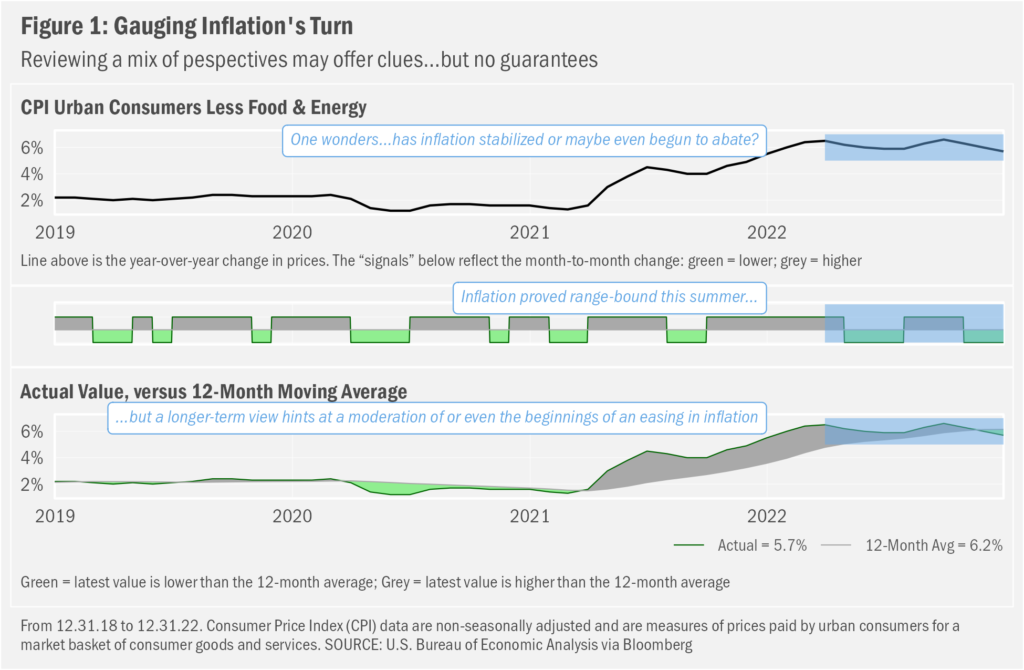

For example, to get a better idea of the direction of change in such data, we can “smooth” the series by computing a “rolling” average. This smoothing will tend to highlight more durable changes, in that the math allows similarly directional movements to stack, resulting in a derivative series that may provide a better sense of the direction of change. In Figure 1, we perform just such math on inflation. We chose the Consumer Price Index as the basis for the review but opted for the version of that index that excludes food and energy. Food and energy prices tend to be more volatile than the prices for other goods and services. Removing them therefore already begins to smooth the inflation data into a series from which we may be able to determine a core trend.

After charting the base series, in the next component of the figure we show a “signal” chart that reflects the change for each month: green for lower rates of inflation and grey for higher rates. Notable is the fact that this series of signals, too, tends to bounce around, making each new data point a not-so-reliable indicator of future short-term shifts. To wit, there are two key points in that series (see the blue boxes in the figure) that show why we might not wish to focus on the latest monthly data alone as clues as to where inflation was heading. In July and August 2021, inflation eased to 4.3% and 4.0%, in that order, from the June reading of 4.5%. But this downturn proved short-lived. Inflation fell again each month from April through June of 2022, ending at 5.9%. Another head fake: inflation rose further to what we hope will prove its peak for this cycle of 6.6% in September 2022.

Recently, Vs. Now

Eyeing those potential pitfalls, there’s a potentially more informative way to look at the data. We could take the noisy monthly data series and slow it down by averaging values over trailing periods. For example, for each month in the series, you could average the value of that month and those of the two months prior to arrive at a “rolling” 12-month average (we also could refer to this series as a “trailing” 12-month average, which incorporates both the rolling aspects and the fact that we assign each 12-month average to the last month in the 12-month series). By averaging those twelve months of data, you’ll tend to tease out the wobbles each month presents to uncover the underlying waves of data. The wider the “window” of the rolling period, the slower and smoother the series generally will become. We can then compare, as we do in the final chart of Figure 1, the smoothed series to the underlying series to compare latest data to trend. And what do you know…it might just be that a period of disinflation has begun, considering the fact that the December value of 5.7% (latest value) was the first reading released in a long time that fell below the 12-month average.

Smooth and Smoother

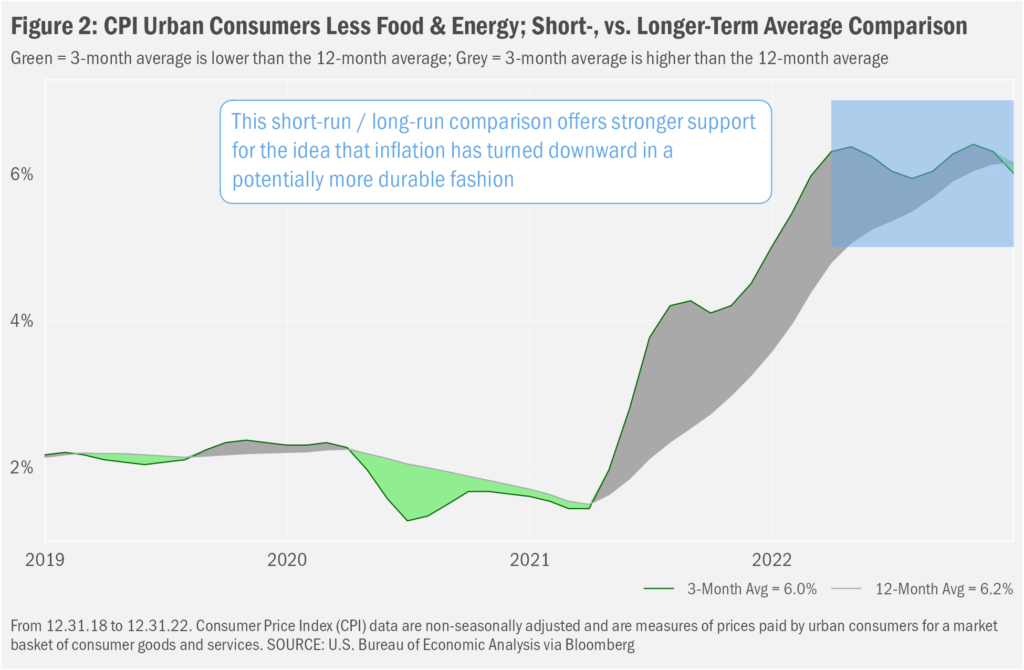

We might not stop there, however. Again, the underlying series remains noisy, so we still might not wish to place too much weight on the latest value alone. Adding further depth to the analysis, we might like to compare a somewhat smoothed, short-term series (e.g., a trailing 3-month value) with a more meaningfully smoothed, long-term series (e.g., a trailing 12-month value). We’ve done this in Figure 2, where we see that inflation still seems to be trending down, even though the average of readings from the latest three months is higher (at 6.0%) than the value for December (5.7%).

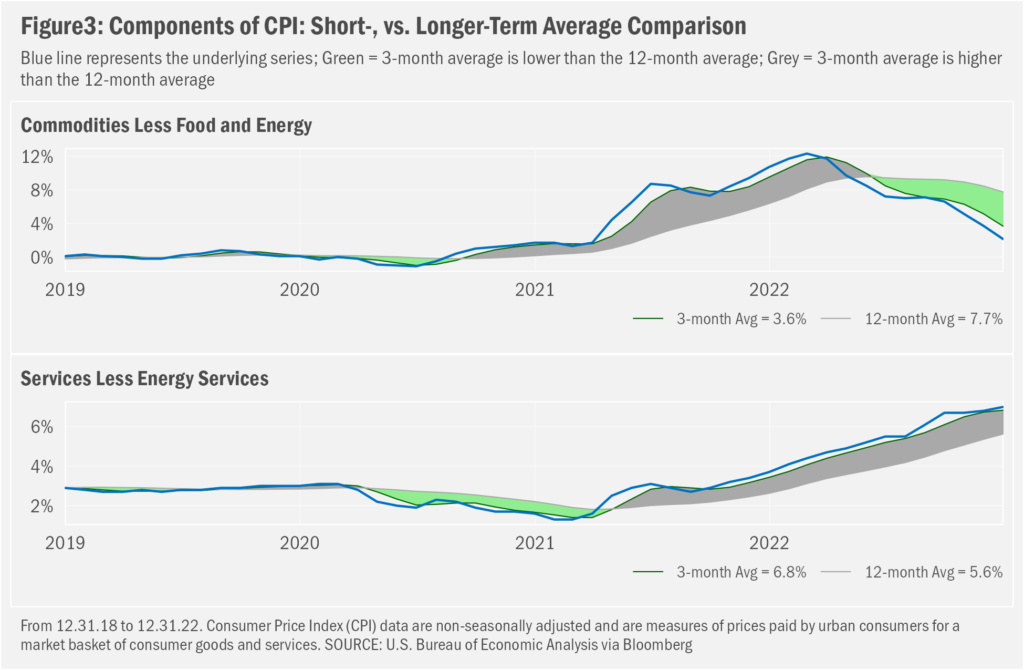

Importantly, even this arguably higher-conviction indicator is by no means confirmation that an actual durable downtrend in inflation has occurred. As we noted last month, the price series underlying the CPI maintain distinct directions and paces of change. While goods prices generally have been easing, services prices have proved more stubbornly inflationary. We chart these differences in Figure 3, where we see that, while goods prices have been trending lower for some time now, services prices are still heading higher.

Market Implications of Disinflation

In his press conference on Wednesday, February 1, after the Federal Reserve announced that it was raising its target for the fed funds rate to between 4.50% and 4.75%, Fed Chairman Jerome Powell said the word “disinflation” or some form of it at least 15 times (judging from the transcript). While he welcomes the relatively more favorable price trends, he acknowledged that his team’s task to suppress inflation is not yet complete, and that there may be, “a couple more rate hikes” in the future before the Federal Reserve is ready to declare an end to this rate-hike cycle.

Seemed markets heard none of that, though. Bonds markets still suggest the Fed is likely to begin cutting rates before the year is out, perhaps under the belief that interest rates are already so restrictive that something more than a mild recession is in store later this year after the Fed implements a few more hikes. And the (inferred) observation that Chairman Powell did not seem too disturbed by an easing in financial conditions that otherwise might put upward pressure on prices (be inflationary)—including the shift lower in longer-term rates and the stock market’s bounce from its October low—saw stocks surge through to the close and still higher the day after.

Perhaps the positive reaction to the news on the stock front was excessive. There were no more data offered during the press conference. And, if anything, Chairman Powell reiterated the planned trajectory of interest rates. So, stock investors may simply be coming around to the idea that the worst of post-pandemic inflation is behind us. After all, the U.S. market is still more than 12% below its January 2022 peak. As for bonds, we remain confident in our decision to maintain a cap on exposure to longer-duration bonds, both for the enhanced yield available across shorter-duration bonds and the potential for longer-term yields to remain volatile against incoming data oppositional to the narrative that seems to support current positioning across the U.S. bond markets.

Important Information

Statera Asset Management is a dba of Signature Resources Capital Management, LLC (SRCM), which is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. Please contact your investment adviser representative to obtain a copy of Form ADV Part 2. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.