Investing naturally presumes expectations for a future result. Certain types of investing can just about guarantee a specific future result. Futures markets can provide such certainty, in that futures contracts are a legal agreement to transact a specific asset on a specific date. Investors can utilize futures markets to manage risk (i.e., by “locking in a future price for an asset”) and to monetize a forecast (i.e., transact in the futures market to take advantage of a view on current mispricing of an asset). Said differently, some investors might choose a futures contract based on a required outcome, while others might choose a futures contract based on a desired outcome. A topic currently of great interest are the evolving views being expressed by federal funds futures:

- Fed funds futures can be used to “lock in” a desired interest rate

- Fed funds futures also can be used to wager on expectations for a future interest rate scenario

- Fed funds futures presently are reflecting expectations for target cuts well greater than 2.5% by the Federal Reserve before the end of next year

- Time will tell whether those expectations are overly or insufficiently aggressive

Expressing a View

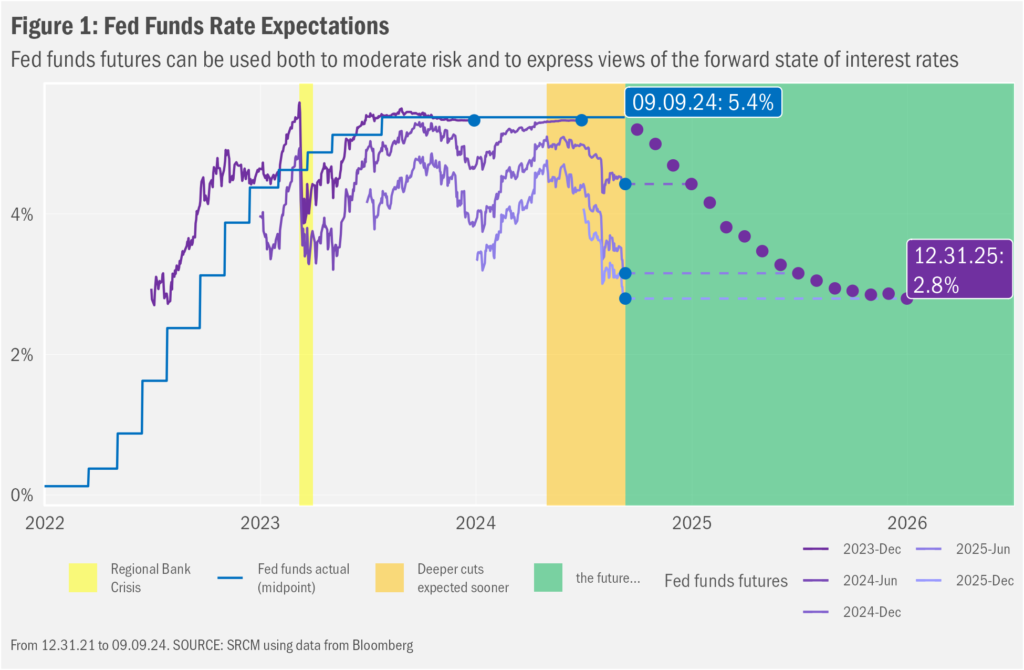

A reference point for economy-wide interest rates, the fed funds rate—the rate for overnight bank lending—is the primary “target” of Federal Reserve monetary policy. The CME Group (a marketplace of derivatives contracts) notes investors can use fed funds futures to “manage risk or express a view on changes in Fed monetary policy” additionally stating, “fed fund futures are a direct reflection of collective marketplace insight regarding the future course of the Federal Reserve’s monetary policy.” We’re focusing on that express a view bit, as the data show investor expectations for monetary policy rates have wavered widely over the past two years. Figure 1 charts both the actual fed funds target and the prices of a few futures contracts to convey these shifts in expectations for interest rate policy over time.

Seasons Change. People Change

Driving those swings in expectations have been shifts in investor sentiment regarding potential Federal Reserve policy decisions based on changes in macroeconomic variables, on Fed members’ interpretations of those data and on actual policy choices. Of central focus have been rates of inflation and unemployment. Where expectations for rates of inflation were “high for longer” or even “higher”, the target rate implied by futures contracts would drift upward; a drift in expectations for “lower sooner” would have seen the implied future target rate fall. Similarly, a stronger-than-predicted (either actual or in the future) economy would be reflected in higher implied target fed funds rates, while growing concerns about an economic slowdown would see futures contract prices implying the Fed would cut rates more rapidly and perhaps more deeply than had been thought.

The swings in sentiment can occur rather quickly. In March of last year, for example, investors seemed to believe that the crisis in regional banks sparked by the demise of Silicon Valley Bank would trigger broader macroeconomic turmoil, forcing the Federal Reserve to cut rates to counteract a slowdown. The rates implied by futures contracts sank as a result. But as those fears of contagion waned, so, too, did predictions for rapid rate cuts. Eventually, expectations evolved to express a “higher for longer” approach to monetary policy that foresaw a Federal Reserve still keen on beating inflation back toward its 2% target amidst an economy that remained rather robust.

Brace for [Soft/Hard] Landing?

Since April of this year, though, investors seem to have become growingly pessimistic regarding the sustainability of growth and employment. While growth-related measures have remained rather vigorous, a range of metrics that includes the rate of job growth and unemployment can be interpreted as collectively indicating a slowdown that has the potential to gain momentum. Too much momentum and the Fed might fall behind in easing policy, potentially exacerbating a slowdown and even precipitating a recession.

As of the end of June this year, the fed funds target implied by the price of the December 2025 contract was close to 4%. As we publish this note, that rate is now 2.8%. At that level, investors are expecting the Federal Reserve to cut rates by 2.5% by the end of next year. In fact, implied rates drop below 3% as early as July next year. Such a rapid change seemingly would require a non-trivial recession, in our view. As we noted last month, when it comes to recessions, what seems always to have mattered most is the trigger for a more rapid deterioration in macroeconomic results and prospects. Sadly, we cannot know what such a trigger will be in advance. But we also have not seen in any data grounds for great concern for an immediate recession.

As generally seems to have been the case in the past, the most likely cause for us, in our view, to be incorrect in that take would be a yet unforeseen event of sufficient magnitude to push the economy off kilter. The unexpected is, of course, the basis for the notion that all investing carries risk. Still, while we might acknowledge that surprises—both positive and negative—are part of the reason that we should expect any return from our investments, we should remain cognizant of our potential comfort with the range of outcomes we might experience from our investments as a consequence of those surprises. Readers should reach out to their advisors where assistance is desired in balancing potential reward from investing with the risk one must assume to achieve them.

Important Information

Statera Asset Management is a dba of Signature Resources Capital Management, LLC (SRCM), which is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. Please contact your investment adviser representative to obtain a copy of Form ADV Part 2. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.