Over the next few weeks, attention almost assuredly will remain focused on the potential ramifications of the incoming Trump presidency. With policy specifics still light, we’ll offer what we find a more immediately relevant review of U.S. stocks: their present collective valuation. By most any measure, U.S. stocks are more expensive than they have been in decades. Those details likely will mean little for the immediate future. But they present context for setting expectations:

- Starting valuations tend to be related to future returns: higher valuations tend to inform lower returns over time

- Primarily due to the outsized influence of several mega-cap stocks (“Magnificent 7”), U.S. stocks are very expensive relative to their own history and versus their global peers

- The dominant driver of investor interest in the Mag7 is the potential benefit of the application of generative artificial intelligence here, there and everywhere

- The operative word there is “potential,” leaving investor disappointment high on the list of potential medium-term outcomes for the broader equity market given this group’s heft

- One can seek to mitigate the potential impact of these non-favorable characteristics via diversification

Expensive Tastes

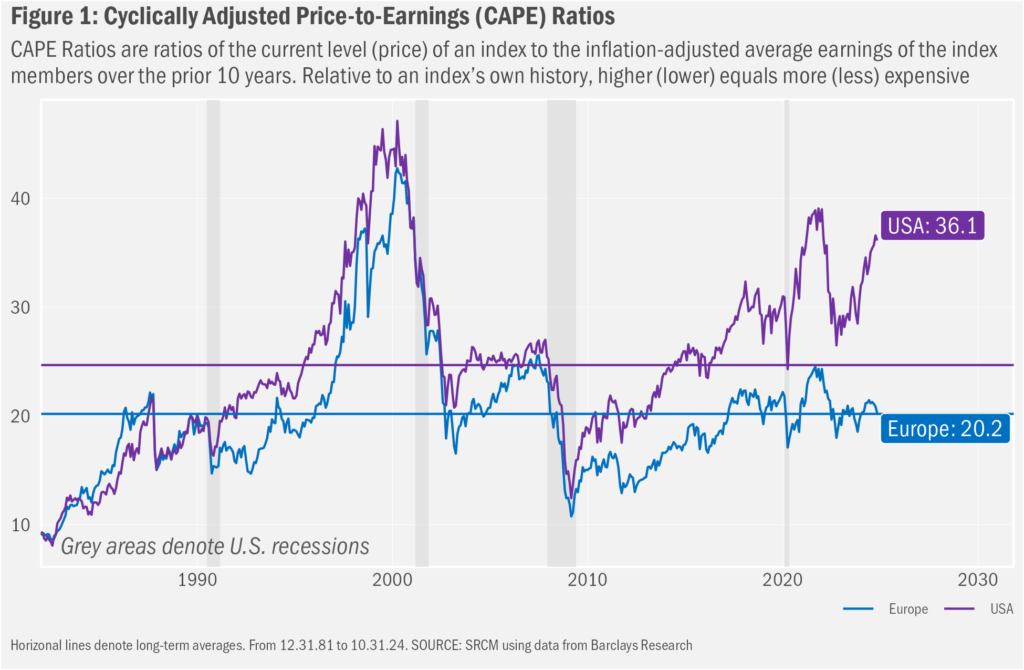

Though the to-the-moon cohort of investors seems to believe otherwise, stock valuations matter. Leaving most aspects of investor behavior aside for now, a stock price should represent investors’ collective assessment of the current value of all the future earnings a company is likely to generate. Stock prices therefore should vary, all other factors equal, based on investor expectations for longer-term growth: the greater the expectations, the more valuable (and therefore more expensive) the share prices are likely to be at present. A quick review of the relative valuation of the U.S. stock market, versus developed market peers, suggests an ample gap in expectations for future growth between the two sets of markets. We show one such popular reference below that compares ratios of index prices to historical inflation-adjusted earnings over the prior ten years. Obvious in the data is the substantial expansion in the valuation gap between U.S. and international developed stocks since the Great Financial Crisis.

To be fair to the more optimistic among us, stocks can “grow into” their valuations. It’s just that history shows those birds to be so rare as to be more imaginative than real. That is, interim stock return disappointments tend to dominate, even for those growth stocks that ultimately demonstrate they may have deserved the earlier high valuation multiples. This historical detail is among the market characteristics that tend to favor a Value-investing orientation. And we can see this tendency more generally in the future returns of the broader equity market when compared to starting valuations. In Figure 2 we plot nearly a century of monthly S&P valuations (as measured by the trailing price-to-earnings ratio of the index using the then latest earnings of the index members) against subsequent 10-year returns for the index (the last value for which we have from 10.31.14). While it’s not a perfect relationship, the data express an indirect association that sees higher (lower) starting valuations tend to relate to lower (higher) longer-term returns. And at 29.1 times trailing earnings, corroborating the CAPE data in Figure 1, the U.S. stock market (or at least the large-cap stocks represented by the S&P 500) is in rare air when it comes to valuations, with relatively few observations as high as they are now (outside of extreme events such as the Great Recession of 2007-09 during which earnings were unnaturally repressed, leading to equally unnatural high valuation ratios).

Worth it?

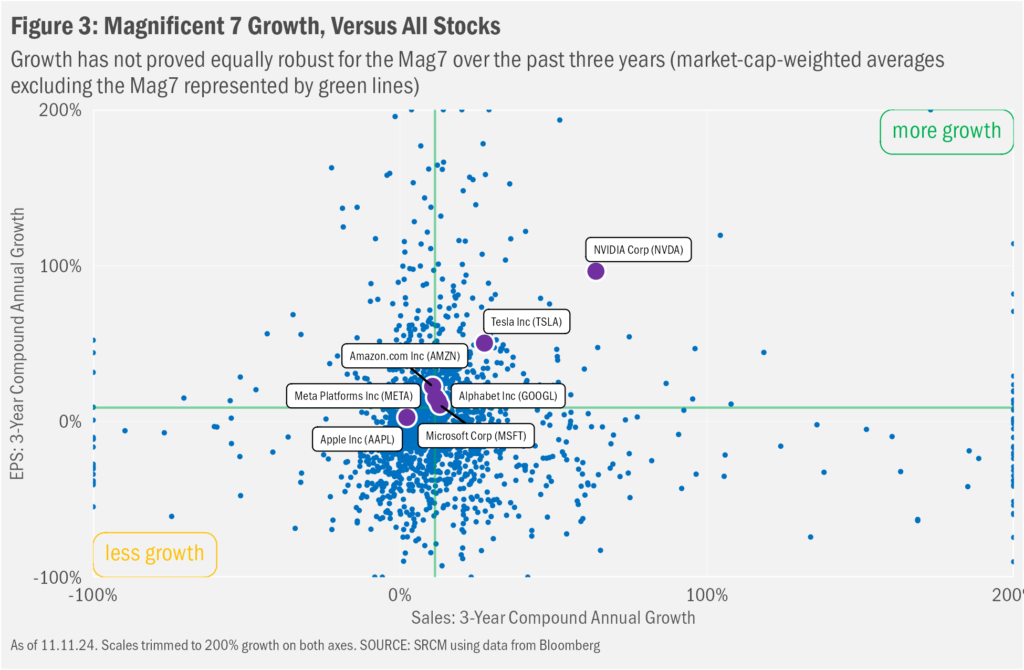

Except...sometimes growth does seem to take on a sustained trajectory that just might lead to the moon. Central to the ongoing strength of the domestic stock market has been the collective performance of the “Magnificent 7”, a group of mega-cap, high-growth, tech and tech-adjacent companies [we wrote a bit about the group in June 2023, which includes Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Alphabet Inc. (GOOG/GOOGL), Meta Platforms Inc. (META), Microsoft Corp. (MSFT) and Nvidia Corp. (NVDA)]. Err...mostly high-growth companies. As we show in Figure 3, the Mag7 display a wide range of sales and earnings growth achievements over the past three years. Most notable in the group have been the stellar gains chipmaker Nvidia has achieved since this time in 2021. Even as once more robust sales related to cryptocurrency mining had been trailing off, sales of chips intended for use in generative artificial intelligence (genAI) tasks have soared. And with Nvidia mostly remaining the only company able to produce leading edge, genAI-focused chips in the quantities desired by myriad end users—including all the remaining Mag7 names—investor expectations remain quite bullish regarding Nvidia’s long-term growth potential.

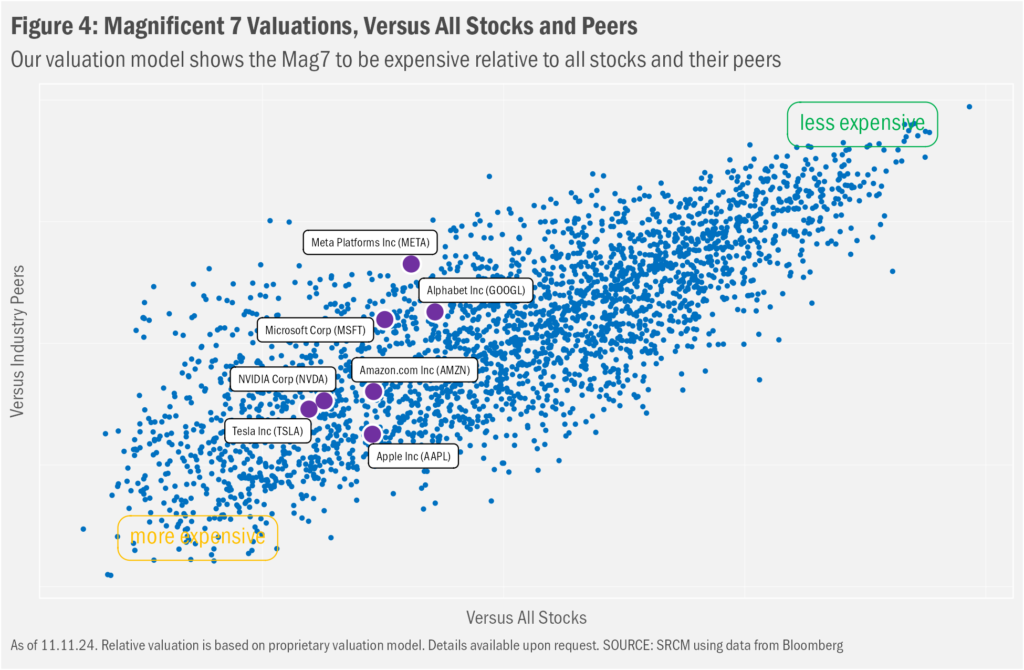

But those growth expectations are reflected in the current valuations of NVDA shares, and similar exuberance can be found across the remaining Magnificent 6. Looking at the data in Figure 4, our internal model for gauging stock valuations—which compares individual company metrics against all stocks and, perhaps more fairly, against stocks within the same industry—we find each of the Mag7 names on the more expensive side of the stock spectrum. Observationally, the valuations are not egregious. But that is in no small part due to the recent surge in earnings (as well as range-bounding and smoothing features we include in the math). And that growth has been driven by top-line (revenue) gains and profit margin expansion in most cases. What happens when either of those trends weakens?

Hey, Big Spender!

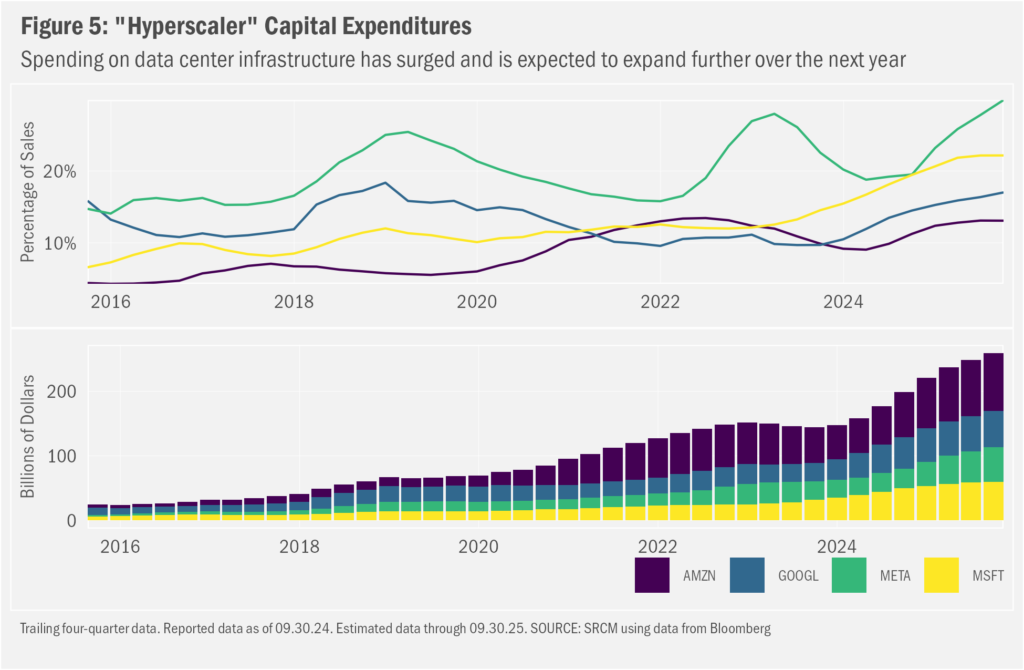

Narrowing our view to a subset of the Mag7, in Figure 5 we show the rise in capital expenditures by Alphabet, Amazon, Meta and Microsoft. The quartet comprises the largest spenders within a larger group known as “hyperscalers”, so deemed...loosely...by the breadth and pace of growth in their data center businesses. Not surprisingly, the dominant focus of the increased spend has been a vast expansion in data center infrastructure, and within that bucket a growing enthusiasm for resources devoted to genAI compute.

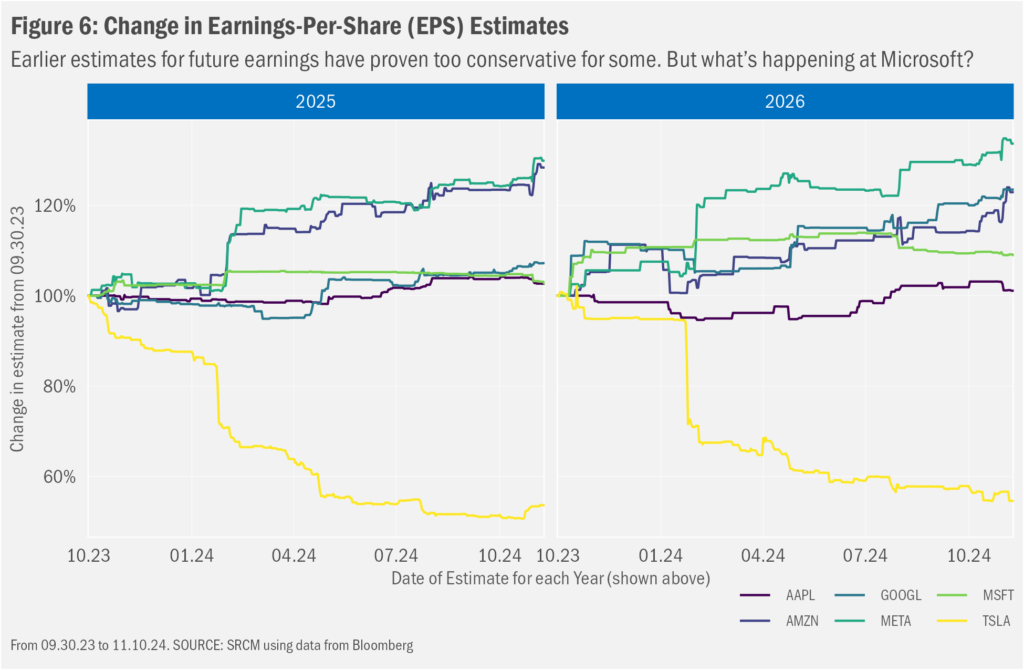

Reading others’ readings of the tea leaves (i.e., analysts’ expectations, offered in Figure 6) it seems earnings growth mostly may remain rather robust over the next two years. We said, “mostly” because we can point to a trend that seems to us increasingly worrisome from a “where do we go from here?” standpoint: those analysts that cover Microsoft have been tempering their fundamental outlooks for the giant software maker/cloud services provider on account of ongoing growth in spending that’s finding substantially less meaningful bottom-line growth. We’re left to wonder, then, if Microsoft’s early struggles are mere speed bumps or omens of what’s to come.

Microsoft is arguably the most active member of the group attempting to sell genAI-related services to end-users in the form of its CoPilot “assistants” for Office 365 (its productivity software suite, which we discussed in our Notes from the CIO podcast in February of this year), for GitHub (a platform for coders) and for the medical profession. Microsoft also touts growth in usage of its cloud infrastructure for genAI computing [meaning resources being utilized by other businesses to build AI models and/or to utilize third-party and/or proprietary models to build services that, in turn, have downstream applications (e.g., models customized to a certain content set to optimize a given user prompt/genAI response scenario)]. Alphabet and Amazon are keen on genAI compute, too. Meantime, all are using genAI for the rather more mundane purposes of better targeting ads and improving search.

Taking that all in, we see several key themes emerging in the genAI space. The first is that spending on genAI infrastructure, to put it mildly, may not be being pursued in the most efficient manner possible. The big spenders admit as much. Back in July during a quarterly earnings call, Meta CEO Mark Zuckerberg referenced growth in genAI-related spending with, “It’s hard to predict how this trend...how this will trend multiple generations out into the future. But at this point, I’d rather risk building capacity before it is needed rather than too late, given the long lead times for spinning up new infra[structure] projects. And as we scale these investments, we’re of course going to remain committed to operational efficiency across the company.”

What’s becoming increasingly clear, however, is that these are still early days of the infrastructure build. And because the hyperscalers are competing to purchase still limited supplies of computing resources (from chips to data center-appropriate real estate), marginal costs remain high. Adding to the spending heft, the hyperscalers seem to be relying on bolstering brute computing power to generate gains in the capabilities of the underlying large language models (faster, but not necessarily more energy efficient chips resolving larger, but not necessarily “better” data sets), which we read as symptomatic of a diminishing rate of return on incremental capex dollars (at least until some “Eureka!” moment is reached, but more on that in a bit...). So capex budgets likely will remain large in the near term and may well continue to grow, heightening the hurdles any revenue model must clear to generate sustainable profitable growth.

All for What?

As we noted, Microsoft’s latest results highlight the mismatch between genAI spending and revenue. And since we understand there’s marginal differentiation in genAI models and computing resources across the genAI compute service providers, with think Microsoft soon won’t be alone in facing increasing investor scrutiny. And as all the hyperscalers seek to pay for the genAI build, we expect competition for genAI-related subscription revenue in all its forms to increase over time, with correspondingly increased pressure on margins.

Still, we don’t yet have a sense of what those revenue-producing genAI products and services will look like. At least, we hope we don’t, because what we’ve seen so far is underwhelming (relative to the infrastructure spend) from a potential revenue standpoint, consisting mostly of support for coding and otherwise more rudimentary, low-value tasks like summarizing e-mails and taking notes from meetings. How these services have captured the imaginations of the average public market equity investor isn’t clear. Sure, there’s a productivity message there, expressed in this press release, which Microsoft referenced during their latest quarterly conference call, stating: “Vodafone, for example, will roll out Microsoft 365 Copilot to 68,000 employees after a trial showed that, on average, they saved three hours per person per week.” Leaving aside our view that three hours sure seems like a lot and therefore likely isn’t a real number, that in another world excess capacity of this sort would be a rather embarrassing statistic for Vodafone, and that, given the more creative, complex and revolutionary potential for genAI technologies, such low-value capabilities should be fringe benefits, not core to the growth model, it has become increasingly obvious to us that the spend will take far greater time to find commensurate return than current valuations reflect.

Said differently, the current capex spend may not be the problem...these companies seem amply able to fund their genAI business endeavors. The challenge is presented in the search for proportionate return on the investments. And amidst all the hype, we have yet to see any provider establish a presumptive revenue stream with sufficient medium-term volume to justify the current extent of investor excitement.

Note that we did not say we don’t think it’s possible to justify the investment in genAI infrastructure. Could be (likely will be, we’d argue) that these massive sums will serve as a foundation for continued learning and innovation that eventually does lead to long-term profit growth. In fact, on its October 30 fiscal first-quarter earnings conference call, Microsoft noted that, “Roughly half of our cloud and AI related spend continues to be for long lived assets that will support monetization over the next 15 years and beyond.”

On that same call, however, we heard, “We continue to see growth in M365 CoPilot seats and we expect the related revenue to continue to grow gradually over time.” The word “gradually” is far from encouraging. To be fair, the company did note that by the end of this quarter its genAI business in total should be set for an annual run rate of $10 billion in revenue. Just 2.5 years in, Microsoft says that level would represent the quickest revenue ramp for any product line in the company’s history. On the other hand, Microsoft’s trailing four-quarter revenue at the end of calendar 2024 presently is expected to exceed $286 billion. So, while $10 billion ain’t nothing, it sure ain’t much.

Revenue ≠ Profit

How far off in the future those eventual profits might be realized remains the essential question for investors to ponder. The problem for equity markets, in our view then, stems from our belief that owners of highly valued shares tend to expect continuing growth in share prices—even in the face of downshifts in near- and medium-term fundamental growth—despite the fact that high valuations already reflect lofty expectations. We therefore expect many investors will find increasing disappointment in medium-term results among the hyperscalers [and likely among the rest of the Mag7 for different reasons: Nvidia likely will face competition at some point, likely from the hyperscalers, who might become a little less anxious in their spending habits, with both trends pressuring Nvidia’s top-line growth and margins; Tesla’s valuation reflects increasingly aggressive expectations for each of its actual and prospective business lines; Apple may struggle to find the next big thing amidst waning growth rates]. Again...this is not to suggest that these companies cannot grow into these valuations. Only that their valuations presently theoretically require that growth in order that their valuations trend toward what in our view would be more defensible levels. Where growth fails to match expectations, disappointments are likely. And since these stocks command such a substantial portion of the market capitalization of the U.S. equity market, purely passive owners of the market may suffer proportionately.

Implications for Market Exposure

So how’s an investor to think about their exposures to trends that 1) have the potential to be broadly transformational, that 2) are prompting a broadly generic technological arms race to solidify individual company competitive positioning, that 3) nonetheless, in our view, currently fail to present realistic revenue streams sufficient to meet suitable return-on-investment requirements, and yet 4) still are finding massive enthusiasm among a swath of professional and retail investors? Well, we think investors should 1) maintain broad-market exposure to capture some of the spirit reflected in #4, while 2) being open to the idea that patience may be warranted in re: #3 above as technology markets have a history of surprising with robust revenue streams that seemingly burst from nowhere, and 3) expecting the various providers to settle into various niches as they find their own momentum amidst the early rushes of this arms race, and in the meantime 4) be open to trying out these various nascent technologies to see whether they, too, might benefit from their (very much in the “promised” sense) eventual promise.

The above roughly reflects our own approach to equity investing. We start by owning much, if not all, of a given market. For example, we generally maintain exposure to each of the Mag7 in our equity portfolios. But instead of passively owning those stocks in the levels reflected by their relative sizes in the market, we tend to tune our exposures to emphasize smaller stocks and those stocks with valuations that skew toward the less-expensive side of the spectrum. That is, our portfolios tend to be shifted in the direction opposite to the characteristics reflected by the Mag7. And we do this because, as we will highlight in next month’s commentary, history suggests the eventual returns for taking on the risk that our portfolios might underperform in the near and medium-term—when investors may have become enamored with themes that glow from their technological promise even as they likely overstate their fundamental promise—more than compensate for the patience that’s required for a more rational reflection of inherent value to more comprehensively be realized.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.