Over the four-plus decades since Americans last braced against a high-inflation environment, investors have seen interest rates sink to fresh lows and rise to lower peaks with each successive economic cycle. Rates are well off recent depths on account of ongoing efforts to ease upward price pressures, bringing positive and negative impacts along with:

- The objective of the “tighter” monetary policy being pursued by the Federal reserve is to pressure the economy in various ways in order to inhibit growth, dampen employment and, thereby, ease inflation

- But higher rates may bring benefits, too. It’s been a long time since we’ve been able to look to bonds as much or more for their expected return as we have for their tendency to suppress overall portfolio volatility

- More generous yields may help investors meet return- and risk- specific targets

- Nonetheless, as ongoing woes within the banking sector demonstrate, the rapid shift higher in interest rates has left some market participants overly exposed to potential losses from the forced sale of bonds now underwater on account of those now higher yields

Listen to this month's Notes from the CIO podcast:

Podcast: Play in new window

Out of the Valley

In each of the three major market crises since the turn of the millennium—the Tech Bubble, the Great Financial Crisis (GFC) and the COVID-19 Pandemic—the Federal Reserve pushed interest rates lower to foster an investment environment more amenable to growth-as-cure remedies. As the sharper impacts of those crises abated, the Fed sought to withdraw its theretofore extraordinary market support. Prior to each subsequent dislocation, though, interest rates never returned to their prior “normal” before realizing new lows on account of even more creative and aggressive attempts by the Fed to maintain proper market function and provide a foundation for macroeconomic stability. By the summer of 2020, rates on U.S. Treasury securities languished at levels not seen in history. Among the consequences of those paltry yields was the increasing inability of savers to look to bonds to generate income.

Latest Episode

Post-GFC, various forces left the Federal Reserve (and other central banks around the globe) concerned about deflation, or insufficient upward pressure in prices, which is thought to hamper macroeconomic growth. We’re collectively still learning about these forces to this day, but the list is thought to include increased regulation of the financial sector and the sobering effects, including heightened fiscal austerity, that tend to come along with financial crises.

Conversely, the path to “normal” interest rates after the pandemic has seen central banks fighting burdensome levels of inflation, or too much upward pressure on prices. We’ll similarly for years be pondering aloud the drivers that have resulted in the highest rates of inflation the U.S. has experienced since the early 1980s, with the list of influences currently thought to include easy-for-too-long Federal Reserve policies and way-too-generous fiscal responses to pandemic-related macroeconomic issues in the form of cash handouts, debt repayment delays and outright forgiveness.

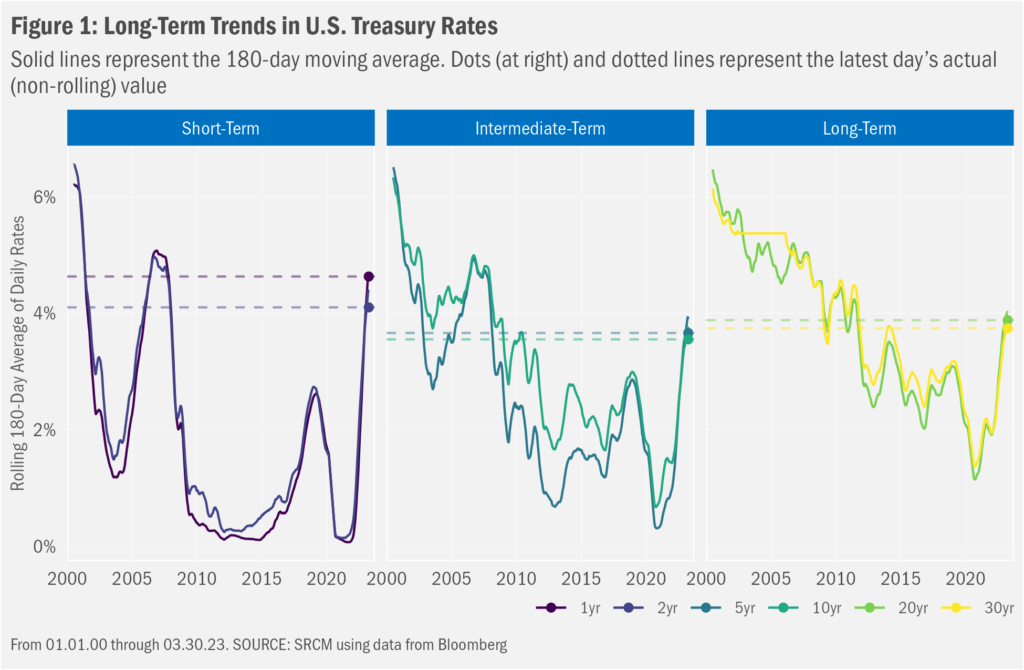

Seeking to quash high and sticky inflation, the Federal Reserve has in a historically abrupt manner raised its target for very short-term lending from an upper bound of 0.25%, established on 03.16.20 to ease financial conditions to counter the effects of the COVID-19 pandemic, to 5.00% on 03.22.23, the highest that target has been since September 2007. While still volatile and well off recent peaks, 6-month average yields on portions of the U.S. Treasury market, in tune with the Fed’s shift in policy, are at levels not seen since the mid- to late-2000s. We chose to show the 6-month average in Figure 1 because, for various reasons, the most impactful of which we’ll get to in a moment, interest rates have proved quite volatile this year. So, we “slowed down” the data (see the February 2023 commentary) to show how meaningfully rates have risen over the past year and a half.

Even so, while shorter-term interest rates (i.e., on bonds maturing in 6 months or sooner) express the likelihood that the Federal Reserve will retain its policy stance in the very near term, yields on bonds maturing over the medium term suggest greater investor uncertainty regarding the potential success of the Fed’s restrictive policies (see Figure 2). It all gets very messy when one attempts to figure out the minds of bond investors, but the thinking is as follows. Longer-term rates have tended to fall relative to short-term rates as inflation trends worsened and/or investors expressed stronger beliefs that to win the fight against inflation, the Fed would have to foster a recession (meaning the Federal Reserve might need to raise rates higher or keep them higher for longer, while potentially in short order having to reverse rate hikes to provide support against a recession). Longer-term rates have tended to rise relative to shorter-term rates as investor fears regarding a potential nearer-term recession eased and/or trends in inflation turned more positive than expected (meaning the Federal Reserve might not need to raise rates as high or keep them high for as long, while not having a reason to reverse rate hikes). The short of it is: investors strain against potentially opposing beliefs that interest rates are sufficiently high to tame inflation, but not so high to spark a recession and a dramatic shift higher in unemployment.

And much of that strain comes from whether the investor believes the Fed’s present stance is one of: still accommodative, less accommodative, neutral, restrictive or overly restrictive. Folks on the “still accommodative” end of that spectrum are more likely to believe that inflation has much more room to run, while those on the “overly restrictive” end likely believe a recession is soon to come. Anywhere in between those two extremes, though, one could maintain beliefs that rest within any matrix defined by opinions on the ongoing impacts of higher interest rates on macroeconomic growth and employment. That is, one could think that Fed policy is sufficiently restrictive and that the policies will result in a taming of inflation, but that a strong recession with many jobs lost might be required for that expectation to prove accurate. Others could agree on the first two bits but think that the economy could muddle through without a recession or a substantial increase in unemployment. As opinions have evolved along with additional Fed policy moves and new data, portfolio decisions will have boosted bond market volatility. That medium-term interest rates presently are so much lower than short-term rates may mean that investors in the aggregate (at least presently) maintain the belief that the Fed is likely to spur a recession that forces an about-face on rate hikes and a return to an accommodative policy stance (see the top part of Figure 2).

However, the Federal Reserve—as expressed in forecasts for interest rates and inflation—to a measurable extent seems to disagree with the bond market on the path presently suggested by the bond markets (by “path” we mean to express the understanding that various bond market measures reflect where investors believe future short-term interest rates will be, accepting that some of that information relates to a premium generally demanded by investors for assuming the risk of an unknowable future). Compared to current yields, expectations for interest rates over the next two years voiced by members of the Federal Reserve Board of Governors remain a good bit higher than those expressed in the current yield curve.

Banks Throw a Wrench

And that gap expanded on account of investor uncertainty regarding the solvency of many smaller members of the U.S. banking system (see in Figure 2 how the yield curve has shifted since the beginning of the year). We provided a market update on March 13 in which we discussed the financial sector tremors, the gist of which is that a host of banks were feeling the consequences of the rapid rise in rates, which left a bulk of their otherwise relatively safe assets underwater. To raise funds to meet depositor withdrawals, the banks were pressured to sell in-the-red securities and lock in those losses. Such sales could impact a bank’s solvency and ability to meet additional requests for withdrawals. A factual component of the failure of Silicon Valley Bank, when large depositors at these banks caught wind of those potential stresses on bank liquidity, which might result in some portion of their deposits not being immediately (or even ever) available, many of those depositors sought to withdraw their monies. Too many such withdrawals over a short time frame and you have what’s known as a bank run. After three banks failed as a result of a rush to the exits, the Federal Reserve and the U.S. Treasury instituted several programs (presently understood to be relatively short-term) to both support the banking system and calm depositor nerves. Seems those programs have so far seemingly succeeded in both areas, but time will tell.

Arguably[1] both an eventual outcome of interest rates that were too low for too long and a direct result of interest rates that rose too high too quickly, stress across the banking sector may have knock-on macroeconomic effects. As banks are forced to reckon with limited liquidity, they may need to pull back on lending. Such a retrenchment in lending is one of the intended impacts of the Federal Reserve’s rate hikes. Higher costs to borrow, along with less availability of and stronger requirements for borrowing may mimic the impact of higher rates. Estimates vary, but opinions suggest that bank-related strains might work like an extra 0.25% to 0.50% rate hike. That potential influence has further contributed to heightened interest rate volatility over the past few weeks as investors incorporate evolving expectations for future Federal Reserve policy decisions in light of these potential add-on effects.

Inflation Still the Focus

Nonetheless, according to the bulk of Federal Reserve commentary, inflation remains top of mind, even as financial market stability diverts some of that attention. And that stance in part contributes to the gap in expectations for the path of interest rates of the medium term. To combat inflation, the Fed will continue to implement interest rate-focused tools. Meantime, the Fed and the Treasury will use complementary programs, not specifically focused on interest rates, in order to maintain stability within the banking sector. One should remember that, per the Federal Reserve and the Treasury (yes...mostly vaguely and perhaps a bit counterproductively; listen to this month’s podcast for more on that), these deposits are not evaporating. Rather, they’re generally just moving to pastures perceived by the depositors as safer. And for those reasons, this episode of banking sector folly seems to us (and many other seemingly rational folks) still to be residing on the manageable side of the crisis scale.

As we noted earlier (perhaps a bit optimistically, but not wrongly), the Fed’s efforts to stabilize banks need not be seen as working against its efforts to fight inflation. Of course, neither has inflation been tamed, nor has the banking system moved past these latest tensions. A fresh spark could incite a fresh run. And services-related pricing pressures may prove more durable, while goods-related inflation could rise anew. Meantime, we’re far from knowing that a recession will prove the result of the combined impacts of the shift in monetary policy and banking stress, but that probability may have increased due to the latter. For now, however, though success in either endeavor is neither assured, nor likely imminent, we continue to think that the Fed is demonstrating that it can manage toward both objectives and that both aims ultimately will be met.

We’ll offer the additional reminder that U.S. stocks remain well below their prior peaks, while history shows that markets have tended to have dropped on account of the potential of a near-term recession and to have rebounded from near-term lows before a recession is officially declared (see our July 2022 commentary). Even so, we understand that readers may have concerns regarding current portfolio allocations in the context of all that we’ve discussed in this commentary. As always, we are happy to discuss those concerns as desired.

Important Information

Statera Asset Management is a dba of Signature Resources Capital Management, LLC (SRCM), which is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. Please contact your investment adviser representative to obtain a copy of Form ADV Part 2. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.

[1] Many believe the present state of inflation and banking troubles are purely faults of Federal Reserve policy. We’d disagree about the “purely” bit (e.g., COVID-related fiscal programs likely were far too generous and, proverbially, banking execs will be banking execs...), but believe there’s sufficient evidence there for blame. Of course, vague counterfactuals generally are of little use and serve mostly to enable those offering the criticisms a chance to pretend that they have the basis for an, “I told you so!”