Seems reasonable to expect that corporate earnings are likely to fall on account of inflation-induced weaker profitability and a slowdown in revenue growth. The growth-stall is likely to stem in part from the Federal Reserve’s efforts to tame that margin-crushing inflation, as the Fed directly intends to provoke a slowdown in macroeconomic activity, perhaps even a U.S. recession, in order to alleviate upward pressures on prices. Data have supported those expectations, but perhaps not as dramatically as many folks might have thought…or hoped. Several aspects of this gap are worth noting:

- The pace of change in perspective matches what we continue to see as the pace of change in fundamentals: slowing inflation against a backdrop of a slowing economy and somewhat eased employment pressures

- Executives are keen to guide investors into an evolving reality, the near- and medium-term future characteristics of which are unknown even to them

- That policy makers, executives and investors alike are slowly steering into fresh realities provides comfort that intensely adverse reactions of all sorts might be limited

Listen to this month's Notes from the CIO podcast:

Podcast: Play in new window

Falling, Not Plunging

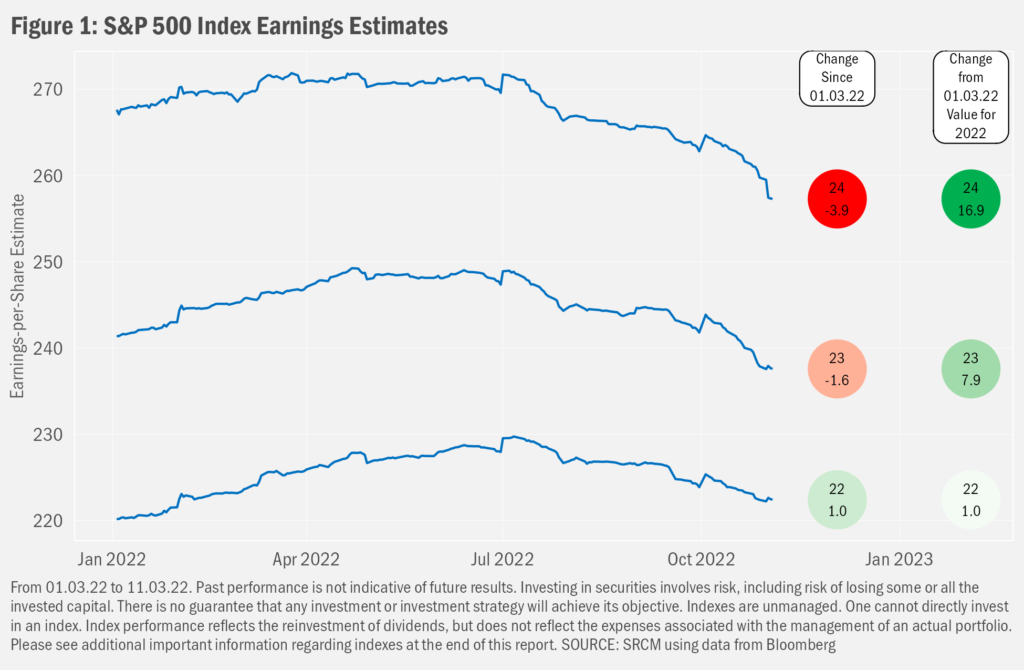

Driven by commentary provided by corporate executives and likely filtered through each analyst’s individual lens on corporate America, earnings expectations for companies within the S&P 500 Index have dropped rather steadily since the middle of this year. These trends surely reflect ruminations on the potential impacts of more restrictive monetary policy, which might slow top-line growth, set against persistent inflation, which could pressure profit margins, along with the evolution of the war in Ukraine and myriad other considerations. For the current calendar year, estimates are just about where they were at the beginning of 2022, though the rainbow-like route those estimates took include a growing deceleration since July. Even so, the pace of decline in optimism has remained rather steadyish in tempo. As importantly, the annual growth figures for the next few years remain positive, at least for now.

Divergence Underneath

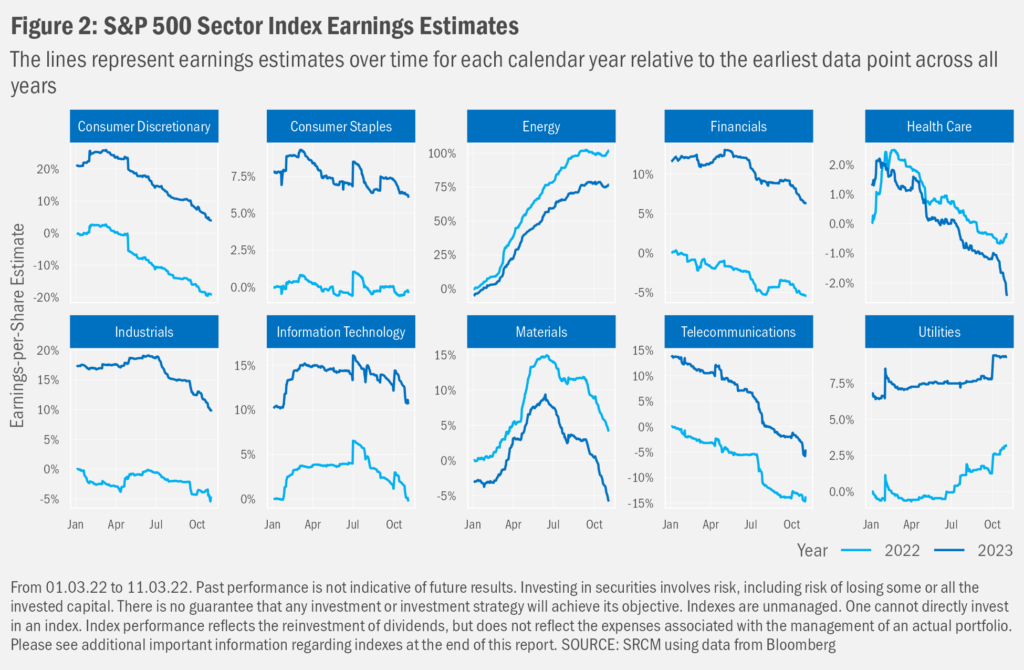

The story isn’t the same for all sectors, though. The Energy and Materials sectors express two different outlooks for prices: energy prices may remain high, while prices for many other raw materials may continue to fall through next year. And oncoming macroeconomic weakness can be seen in the divergence in expected fortunes of the cyclical Consumer Discretionary group relative to the generally more stable Consumer Staples group. With the exceptions of Energy and Utilities, expectations for which remain higher now than in the summer, earnings forecasts at the sector level are flat at best from summertime views, with dramatic declines far more common.

Could be Worse

So earnings expectations in the aggregate hide contradictory trends underneath. Even with that understanding, many commentators still seem rather confident that the data—maybe all the data—are a ruse. That corporate execs might be telling half-truths in order to let investors down lightly as sales and margins deteriorate more quickly than their outlooks suggest. Or even worse (and more cynically), not divulging their dire circumstances for fear of scuttled year-end bonuses. On the flip side, execs might be telling the full truth as they presently perceive it, thereby demonstrating that the economy is not slowing sufficiently and that inflation will prove more persistent than desired such that the Fed will have to work harder for longer to tame it, potentially leading to a worse-than-now-expected recession.

Either of those beliefs suggest another market dislocation is in order: from a kitchen-sink acknowledgement that earnings are much worse than folks had expected or that the outlook for monetary policy will have to become much more restrictive than presently thought. Neither is out of the question. In fact, some manner of both is possible.

Should be Worse?

But that does not mean a market dislocation is a required result of some or all of both being true. Much depends on the rate of recognition of an environment being different than earlier had been thought. To the extent that the changes continue along a path of incremental deterioration (within some range of lower-bounds, of course), investors may find that the present still hefty drawdown in equity markets relative to the January peak, along with much higher interest rates (compared to the past decade, at least) sufficiently acknowledge potential circumstances. Still more volatility would likely be in store, but perhaps not substantial additional downside.

Of course, a more dramatic shift in trend is possible. But such is the nature of the uncertainty that comes along with investing. The “risk” part of the risk premium that is demanded by the expected return that investing is meant to present. As always, we are happy to discuss the potential ramifications of any such potential surprises on existing and/or considered portfolio exposures.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.

The S&P 500 Index measures the performance of the large-cap segment of the U.S. equity market.

One cannot invest directly in an index. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Investing in any investment vehicle carries risk, including the possible loss of principal, and there can be no assurance that any investment strategy will provide positive performance over a period of time. The asset classes and/or investment strategies described in this publication may not be suitable for all investors. Investment decisions should be made based on the investor's specific financial needs and objectives, goals, time horizon, tax liability and risk tolerance.